.jpg)

Investment bodies set for merger to spur confidence, growth

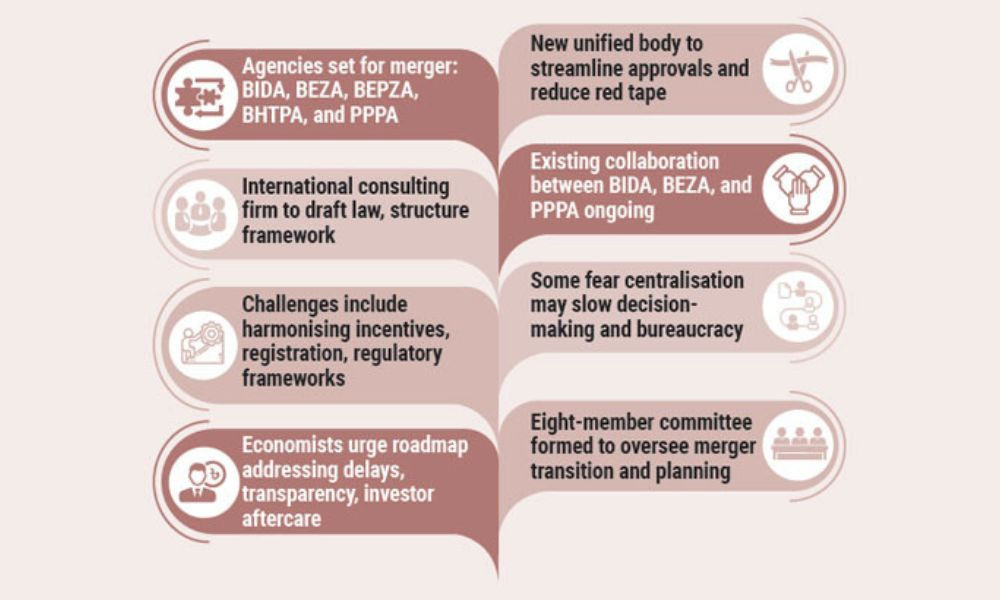

Bangla Press Desk: The interim government is set to consolidate the country’s main investment promotion bodies in-to a single entity within the next four months, in a bold bid to simplify approvals, reduce duplica-tion, and present a more investor-friendly platform.

The move, officials say, is aimed at accelerating investment inflows and providing a one-stop service for both domestic and foreign investors.

Senior officials at the Bangladesh Investment Development Authority (BIDA) confirmed to the Daily Sun that a high-level committee is already working on the merger, which involves preparing operational guidelines, drafting the necessary legal frameworks, and proposing a new name for the unified agency. An international consulting firm is expected to be appointed to help draft the legislation and design the institutional structure of the new body.

The consolidation will bring together five agencies: BIDA, the Bangladesh Economic Zones Au-thority (BEZA), the Bangladesh Export Processing Zones Authority (BEPZA), the Bangladesh Hi-Tech Park Authority (BHTPA), and the Public-Private Partnership Authority (PPPA). Sources indicate that BIDA, BEZA and PPPA are already cooperating to some extent, while BEPZA and BHTPA will be fully integrated following the restructuring.

Officials argue that merging these agencies will enhance coordination, reduce bureaucratic red tape, and provide investors with streamlined services through a single point of contact.

“The goal is efficiency, but such a structural overhaul must be carefully designed to avoid com-plicating the investor experience,” a BIDA official said.

Not all reactions have been positive. Some insiders have expressed concern that centralising au-thority may slow decision-making and introduce new bureaucratic delays, potentially undermin-ing the “fast-track” provisions that currently exist under the laws governing these agencies.

Each agency presently operates under its own legal and operational framework, designed for dis-tinct sectors ranging from economic and export zones to hi-tech parks and public-private partner-ships.

Integrating these diverse mandates will require extensive legal harmonisation and policy align-ment.

Differences in incentive packages, investor registration processes, and regulatory mechanisms present significant challenges to creating a truly unified system.

Economist Dr Mustafa K Mujeri welcomed the merger as a step in the right direction but cau-tioned that structural reforms alone would not be sufficient.

“The merger must be backed by a clear, actionable roadmap that identifies and resolves the actual pain points faced by investors,” he told Daily Sun.

Dr Mujeri added that, despite previous initiatives by investment authorities, actual inflows have consistently fallen short of national targets.

“Without addressing root causes, such as procedural delays, lack of transparency, and weak af-tercare services, the merger may not deliver the desired results.”

To oversee the transition, the Chief Adviser’s Office has formed an eight-member committee fol-lowing a recommendation made at a BIDA Governing Board meeting on 13 April, chaired by Chief Adviser Prof Muhammad Yunus.

An official gazette notification was issued on 30 April. The committee is led by Industries Ad-viser Adilur Rahman Khan, with BIDA and BEZA Executive Chairman Ashik Chowdhury act-ing as member secretary.

Other members include Commerce Adviser SK Bashir Uddin, Chief Adviser’s International Af-fairs Envoy Lutfey Siddiqi, Bangladesh Bank Governor Dr Ahsan H Mansur, Principal Secretary M Siraz Uddin Miah, Senior Secretary of the Ministry of Public Administration Md Mokhles Ur Rahman, and Finance Secretary Md Khairuzzaman Mozumder.

Bangladesh is seeking to position itself as a leading investment destination in South Asia, making the timing of the merger critical. Success will depend on the government’s ability to balance cen-tralisation with operational flexibility, align legal and regulatory frameworks, and maintain open communication with investors.

Stakeholders says that if implemented effectively, the unified agency could significantly improve the ease of doing business; if mismanaged, it risks becoming yet another bureaucratic layer that slows rather than accelerates investment.

BP/SP

YOU MAY ALSO LIKE

.jpg)

Tk5.68cr budget announced at open budget session in Noakhali