Investors in peril as shares worth Tk1,141cr frozen

Bangla Press Desk: Investors of five Shariah-based banks have been left in shock after the Bangladesh Securities and Exchange Commission (BSEC) suspended trading of their shares following Bangladesh Bank’s move to dissolve the banks’ boards and declare their share value zero.

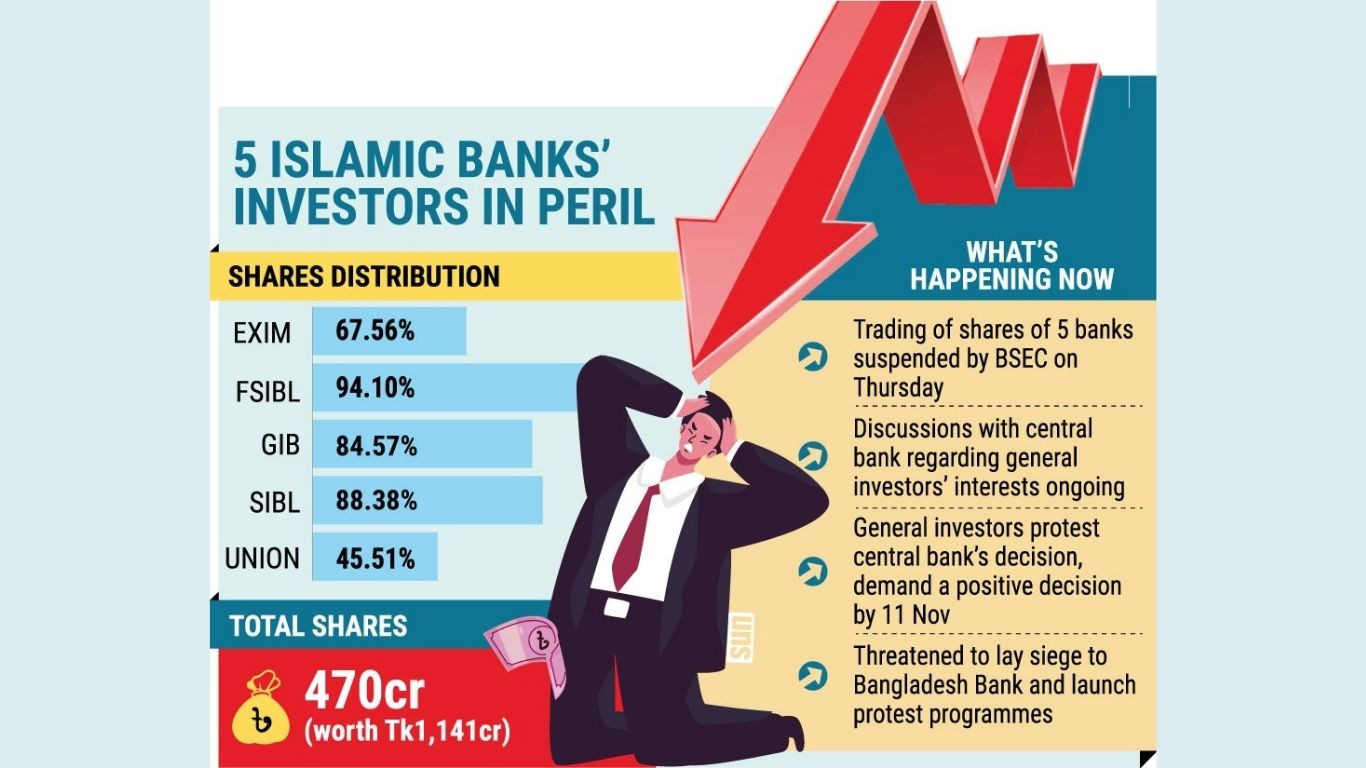

The decision has put 470 crore shares worth Tk1,141 crore — held by institutional, foreign, and general investors — into deep uncertainty.

The BSEC suspended the trading of shares of five Shariah-based banks on Thursday as they were currently facing a liquidity crisis.

Earlier, on Wednesday, the Bangladesh Bank dissolved the boards of these five banks, appointed administrators to oversee them, and announced that the share value of these banks would be zero.

As a result, institutional, foreign, and general investors holding a total of 470 crore shares in these five banks have fallen into deep uncertainty.

According to the latest transaction data, the market value of 470 crore shares held by general investors in these five banks is Tk1,141.65 crore.

While the BSEC has not yet provided any clear solution regarding these shares, market analysts say that the government should consider the fate of all shareholders except for the sponsor-directors.

5 banks’ investors to get ‘nothing’

The five banks in question are — First Security Islami Bank PLC, Global Islami Bank PLC, Union Bank PLC, Social Islami Bank PLC, and Exim Bank PLC — all of which are listed on the capital market.

According to the latest shareholding data, Exim Bank of Bangladesh PLC has 67.56%, or approximately 144.75 crore shares, held by institutional, foreign, and general investors, while the remaining 32.44% are owned by sponsor-directors.

First Security Islami Bank PLC has 94.10%, or 80.36 crore shares, held by general investors, and 5.90% by sponsor-directors.

In Global Islami Bank PLC, 84.57%, equivalent to 83.5 crore shares, is held by general investors, with 15.43% belonging to sponsor-directors.

Social Islami Bank PLC has 88.38%, or 114.01 crore shares, owned by general investors, and 11.62% by sponsor-directors.

Meanwhile, Union Bank PLC has 45.51%, or 47.16 crore shares, held by general investors, while 54.49% of its shares are owned by sponsor-directors.

On Wednesday, at a press conference, Bangladesh Bank Governor Ahsan H Mansur said “Shareholders will get nothing since the asset value of their holdings is negative.”

He explained that the central bank is not considering them, as they carry no liabilities. “In short, the shareholders of the merged banks will not receive any return,” he added.

Capital market analyst and ICB Chairman Abu Ahmed told the Daily Sun that the dissolution of the five boards was a good decision for restoring discipline in the banking sector. “However,” he added, “these banks are listed companies, and the government has responsibilities toward those who invested in their shares.”

He further said, “It is true that the five banks have a negative Net Asset Value (NAV). Although Bangladesh Bank said that investors should have known better before buying shares of banks with negative NAVs, the fact remains that when shares are sold on the market, someone has to buy them — and those buyers are also investors. So, it would be unfair to neglect institutional, foreign, and general investors.”

Ahmed added, “While depositors will naturally be prioritised in recovering their money, the government and the BSEC must also consider the situation of the investors.”

BSEC’s new spokesperson Md Abul Kalam said, “From the very beginning of the merger process, we have been in discussions with Bangladesh Bank regarding the general investors’ interests. The discussions are ongoing, and we hope the government will take the matter seriously. Trading of the five banks’ shares has already been suspended.”

General investors protest strongly

Meanwhile, general investors have strongly protested the central bank’s decision. They have given the government until 11 November to make a positive announcement regarding the return of their investments. Otherwise, they have threatened to lay siege to Bangladesh Bank and launch protest programmes, including blockades.

At a press conference under the banner of the Bangladesh Capital Market Investors Unity Council, the organisation’s president, Mizanur Rashid Chowdhury, said, “We demand the resignation of the Finance Adviser, the Governor of Bangladesh Bank, and the BSEC Chairman by Saturday (8 November) midnight. If they do not resign, we will stage a mass protest and lay siege to Bangladesh Bank at 2pm on Tuesday (12 November) along with the investors and depositors of the five banks.”

Five banks trade below face value

Over the past three months, the share price of Global Islami (listed in 2022) fell from Tk3.2 to Tk1.7, First Security (listed in 2008) dropped from Tk4.5 to Tk1.9, Exim Bank (listed in 2004) slid from Tk6.5 to Tk3, and SIBL (listed in 2000) dropped from Tk8.5 to Tk3, largely on merger news. The share price of Union Bank (listed in 2022) fell from Tk3.1 to Tk1.5.

This negative trend has weighed on investor sentiment across the entire banking sector. Of the 36 listed banks, only about a dozen are now trading above their face value of Tk10.

Between September 2023 and May 2025, the deposits of these troubled banks fell from Tk1.58 trillion to Tk1.36 trillion, while their total loans increased to Tk1.95 trillion. Non-performing loans (NPLs) surged to Tk1.47 trillion, representing a staggering 77% of their total loan portfolio.

Amid mounting defaults and declining depositor confidence, the Bangladesh Bank initiated the merger plan to form a single, stronger Islamic bank. This article was originally published on the Daily Sun.

BP/ZE

YOU MAY ALSO LIKE