Bangladeshi-Born researcher Masud Kowsar opening new horizons in Banking and Finance

Staff Reporter: The global banking and financial sector is undergoing rapid transformation, fueled by emerging technologies such as Artificial Intelligence (AI) and blockchain. At the forefront of this evolution is Bangladeshi-born researcher Md Masud Kowsar, whose work combines hands-on banking expertise with cutting-edge financial research.

With nearly a decade of professional experience in Bangladesh and current research activities in the United States, Kowsar is playing a significant role in shaping the future of credit risk assessment and financial inclusion.

Banking Career in Bangladesh

Kowsar began his career in Bangladesh’s competitive banking sector, serving in key positions such as Branch Credit Assessment Officer, Regional Credit Assessment Officer, and Branch Relationship Officer. Over eight years, he gained expertise in loan evaluation, credit risk analysis, customer relationship management, and branch–regional coordination.

“Banking is not just about numbers, it’s about understanding people, communities, and the ripple effects of financial decisions,” Kowsar said in reflection. “I learned the value of accuracy and empathy in lending.”

Academic Background and Research

Holding both a Bachelor’s and Master’s degree in mathematics, Kowsar developed strong analytical and statistical skills that underpin his research. His mastery of mathematical modeling enables him to interpret complex data and identify patterns critical to financial decision-making.

“Mathematics gives you a lens to see patterns where others see chaos,” he remarked. “In finance, that can mean the difference between making a sound loan decision and taking on unnecessary risk.”

Currently, Kowsar is pursuing an MBA at Indiana State University’s Scott College of Business and works as a Graduate Assistant with the Student Managed Investment Fund Consortium (SMIFC). He is also a Stock Analyst for the university’s Investment Club.

Contributions to Financial Research

Kowsar has published seven research papers, three of which are drawing particular attention for their practical implications:

Mathematics for Finance: A Review of Quantitative Methods in Loan Portfolio Optimization- analyzing 87 studies published between 2000 and 2024 to improve credit risk management.

A Systematic Review of Credit Risk Assessment Models in Emerging Economies: A Focus on Bangladesh’s Commercial Banking Sector — addressing challenges unique to his home country.

Blockchain in Banking: A Review of Distributed Ledger Applications in Loan Processing, Credit History, and Compliance-showing blockchain can cut loan approval times by 40% while enhancing transparency and security.

“Research is most valuable when it translates into better practices,” Kowsar said. “If a paper can help a banker approve a loan faster and more fairly, then it’s worth the months of work.”

Vision for the Future

Looking ahead, Kowsar aims to develop AI- and blockchain-driven credit risk models that make lending decisions faster, fairer, and more transparent. He believes such innovations can expand credit access for small businesses and entrepreneurs, particularly those underserved by traditional banks.

“Technology alone won’t change the financial system,” he noted. “It must be combined with appropriate policies and human judgment. That’s how we foster trust and inclusion.”

From Bangladesh to the United States

Kowsar’s journey- from community-level banking in Bangladesh to high-level research in the U.S- reflects both ambition and social commitment. His work continues to contribute to global efforts for efficiency, fairness, and stability in banking.

“No matter where I work, I carry my roots with me,” Kowsar emphasized. “Bangladesh shaped my values; the U.S. is shaping my opportunities. Together, they inspire my vision for a better financial future.”

[Bangla Press is a global platform for free thought. It provides impartial news, analysis, and commentary for independent-minded individuals. Our goal is to bring about positive change, which is more important today than ever before.] BP/CSYOU MAY ALSO LIKE

-696d02aa3f348.jpg)

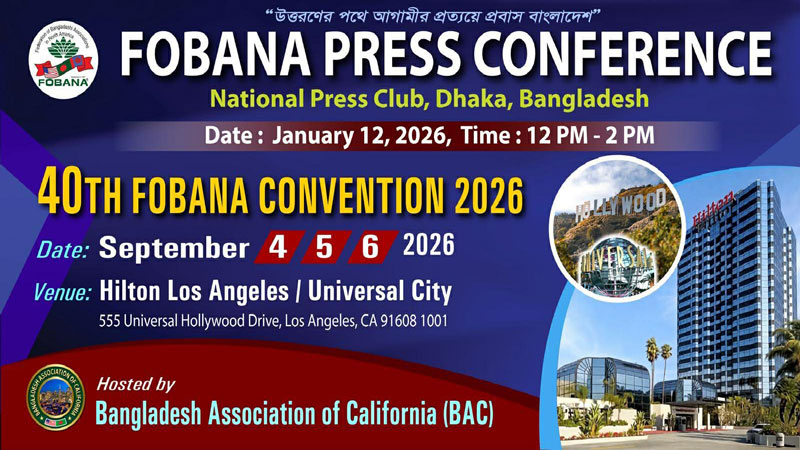

40th FOBANA Press conference to be held on January 12 in Dhaka

Demand to shut down Indian TV channels to prevent anti-national propaganda